A large part of success is in knowing yourself. This is true whether you are starting a relationship, or whether you are working towards a financially stress free life. If you want to create success in personal finance, then you want to cultivate the behaviors that will lead to financial freedom. Here are some things to consider about yourself to help you achieve your financial goals:

What are Your Strengths?

One of the best things you can do is to acknowledge your strengths. Figure out what you are good at and see if you can turn those into extra income. Consider your strengths as they relate to money. Do you have skills that others are willing to pay for? Can you create something with your hands that others are willing to buy? Do you research well? Do you have good self-discipline? Recognize your strong points, and find ways to apply them to your financial life. You’ll be able to accomplish more, and do it faster, if you can create a financial plan that plays to your strengths.

What are Your Weaknesses?

It’s fun to acknowledge your strengths. It’s an exercise in feeling good about yourself, and recognizing what you do well. Your weaknesses, on the other hand, are not as fun to acknowledge. But it needs to be done too. Take a look at where you could use some work. Are you lax when it comes to tracking your spending? Do you have a hard time saving up for your goals? Instead of developing your talents or your mind, do you spend too much time in wasteful pursuits, like video games and TV? Take a look at some of your weak points. Create an action plan to change the way you do things so that your weaknesses gradually become strengths.

What Do You Want to Accomplish?

Now that you have an idea of your strengths and weaknesses, it is time to determine what you want to accomplish. It really does help to have a plan for your money. Before you make your plan, though, you need to know what you want your money to accomplish. Carefully consider your values and your goals. You can use this as inspiration as you work toward financial freedom. Knowing what you want to accomplish, especially if it’s important to you, will help you stay focused.

What are Your Triggers?

Many of us have triggers that can lead to undesirable financial behaviors. If you know that you spend money when you are upset, it might be a good idea to stay away from the mall, or online shopping sites, when you are feeling blue. If you feel flush on pay day, and excited enough to go spend the money, perhaps you sign up for a direct deposit program that puts more of your money in a retirement account, orsome other savings account. That way you will have less immediate income at your disposal. Think about what triggers your poor money decisions, and look for ways to circumvent them.

Bottom Line

Understanding yourself and the way you interact with money is an important part of financial success. Once you know the underlying reasons for your actions, you will be more likely to fix your money problems and adopt practices that are better for your pocketbook.

Read the full article at: moneyning.com

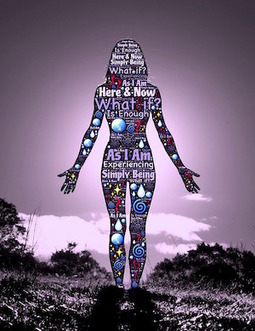

Self-reflection is a key to achieving financial freedom. #knowthyself #familybankgame #achievest