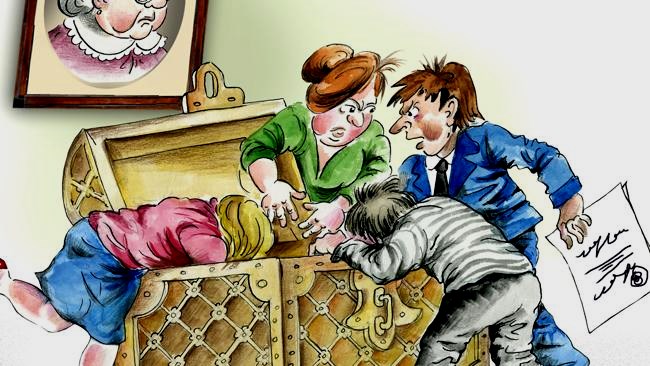

The research isn’t pretty: The chances are good that your heirs will end up fighting over your estate and, in the process, squander a portion of their inheritance. But the right kind of advance planning today can help minimize battles in the future.

An estimated $30 trillion of wealth worldwide will be passed from older generations to younger generations in the next 30 to 40 years, according to consulting firmAccenture.

But about 70% of families will lose part of their inherited wealth, primarily due to estate battles, according to research by the Williams Group, a San Clemente,Calif., firm that helps families avoid such conflicts.

Families can take several steps when building their estate plans to head off such strife. Among them:

Decide what “fair” means. Given that different assets and possessions will have different values for different family members, dividing an estate into equal shares can be difficult at best. But a focus on “fairness” can help.

A parent, for instance, might decide to leave more money to an adult child who struggles financially and a smaller inheritance to a child who has struck it rich on her own. A disabled child might need to inherit funds for long-term care – but wouldn’t find much use for a family vacation home.

“When it comes to property and possessions, it’s almost impossible to be equal,” says Marlene Stum, a professor of family social science at the University of Minnesota in St. Paul and author of a book about the family dynamics of inheritance, “Who Gets Grandma’s Yellow Pie Plate?”

Itemize – and start talking. Make a list of your assets, including financial accounts, retirement savings and life insurance. (Also note who you have named as the beneficiaries of those assets.) Then add homes, big-ticket property – such as furniture, jewelry and family heirlooms – and consider who you want to inherit those items.

At this point, ask family members for their input. You might think your daughter wants the Steinway piano when she doesn’t, or you might have given little thought to a box of old holiday decorations while all three of your children are maneuvering to claim it for themselves.

Says David Cutner, an elder-law attorney at Lamson & Cutner in New York: “It’s not about the money. It’s more about, ‘Did Mom or Dad love me?’ ”

Even the score. Instead of itemizing who gets what, a simple way of dividing assets is to get your property and possessions appraised and then have the children or grandchildren take turns choosing what they want while you are still alive, says Ronnie Ringel, a managing director at Fiduciary Trust in New York, a unit of asset-management firm Franklin Resources. Disputed items could be offered for bidding in a family auction.

Perhaps most important: Be consistent and clear. For instance, if one in-law is allowed into the decision-making circle, all of them should be. Listening only to the most outspoken child and ignoring the rest, or being unclear about how and why a certain decision was made regarding assets also can breed mistrust.

“People change their minds or the children don’t necessarily want what you plan to give them,” says Ms. Stum in Minnesota. “Sometimes it’s nice to keep things flexible.”

Read the full article at: blogs.marketwatch.com

The Family Bank Game encourages families to create an open dialogue about #money which can prevent problems down the road! #educateyourself #familybankgame